Do you remember those nights as a little kid when you were expecting the tooth fairy to come and leave money under your pillow?

Do you remember those nights as a little kid when you were expecting the tooth fairy to come and leave money under your pillow?

I’ve found the grown-up version of the tooth fairy that’ll leave you a hefty little sum under your pillow for you to wake up to. Think about how nice it’d be to lay your head down at night knowing that you’re in for instant profits in the morning.

This trick works for me time and time again, and it’s all thanks to the clues that the insiders keep leaving behind. It’s like you’re able to scam Wall Street before it scams you.

I keep worrying that the insiders are going to realize that they’re leaving these clues behind and try to cover their tracks, so you’ll have to act soon.

If you’re like me, you often lay your head on your pillow and dream about waking up to an overnight payout that’ll solve all your financial woes.

I dreamt about the same thing my whole life until I finally came up with a simple method that makes this dream a reality.

There’s a lot of scams out there that promise to make you a millionaire overnight—these ploys always rip you off for all you have and never provide a single dime.

This system that I’ve worked out allows you to scam Wall Street overnight and wake up to a heavy profit, so you can dream about what you’re going to do with your money instead of how you’re going to get it. And the best part of it is that it’s 100% legal.

We’ve recently entered earnings season on Wall Street and the insiders who are making massive amounts of money off insider trading are unknowingly leaving clues behind that we’re able to take full advantage of.

Earnings reports are all set to release around the same time period in the fiscal year.

The fiscal year is set up in 4 quarters: Q1 is October through December, Q2 is January through March, Q3 is April through June, and Q4 is July through September.

Each public company provides an earnings report for the previous quarter which is measured in earnings per share (EPS). The company will have published a projected EPS which is then compared to their actual EPS.

If the company outperforms their projected EPS, then the stock price for that company will rise. In the same sense, if the company underperforms and doesn’t reach their projected goal, their stock price will fall.

Even though it’s illegal, there are people inside every company that get the earnings numbers earlier than the public and buy or sell shares depending on what the outcome is.

They think they’re being smart by doing this, but with this system I’ve come up with, their dirty little tricks are all exposed, and you’re able to collect your overnight payout.

Like I said earlier, we’ve currently entered earnings season, and are in the midst of seeing Q1 earnings from all the companies that are public.

In order to clarify my little overnight payout trick, I’m going to introduce you to a vital tool that’s available to you through stockcharts.com.

In the charts below we want to focus mainly on the red and grey vertical bars that run along the bottom of the chart. These are called volume bars, and they measure the amount of buying and selling that’s occurring in a specific stock each day.

The first chart I’d like to point out is American Airlines (AAL). AAL released their earnings late on January 27th. As you could see, they didn’t reach their EPS goals and that was reflected in their stock the next trading day.

Notice the size of the red (selling) bar right before they released their earnings. Maybe there were people who knew about the loss in earnings and wanted to sell the stock before it plummeted.

If you would’ve shorted AAL within the hour of its closing price on the 27th, you would’ve woken up to an 8% profit in less than 24 hours.

If you would’ve bought or sold an option on this stock, the gains could’ve been a whopping 50%.

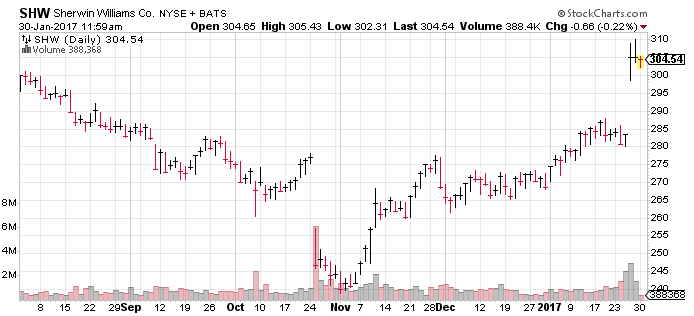

The chart below for Sherwin Williams (SHW) shows the same type of movement but in the opposite direction. SHW released their earnings on January 26th, which turned out to be very positive for their stock price.

The insiders for SHW were a little more subtle about their purchases as you can see the grey (buying) volume bars increased gradually.

If you would’ve bought shares in SHW on the 25th based on the gradual buying volume, you would’ve made 9% and could’ve turned $5,000 into $5,450 in a single night. Again, the options on this one would’ve taken those profits through the roof, looking at 60% or more.

Unusual growth in trading volume usually means something is happening on the inside, and people are taking advantage of their insider knowledge.

Reading a stock’s chart is like reading a treasure map: it’s all there if you know exactly what you’re looking for.

If you’re able to act at the right time by using this tool, and the others we offer through various newsletters and special reports, you’ll be able to lay your head down knowing that you’ll wake up to an overnight payout.