The election of Emmanuel Macron as France’s new president isn’t just something that’ll be celebrated by 65% of French voters…

The election of Emmanuel Macron as France’s new president isn’t just something that’ll be celebrated by 65% of French voters…

You’ll be joining their celebrations after I reveal the profits that are coming our way through the Euro.

Ignore all the noise you hear about buying and selling the Euro, because I’m going to show you why the insiders are showing us exactly what to do…

The election of Macron came as a surprise to many as he beat out the seemingly favored Marine Le Pen, and the stock market reacted just as it should’ve.

The S+P 500 ($SPX) gapped up 1% after the news, while the Nasdaq ($COMPQ) jumped 1.2% and the Dow Jones ($INDU) jumped 0.8%. The Euro jumped more than 2% at the same time.

Macron is a big advocate for France remaining in the EU, while continuing to use the Euro as its currency.

And even though the Euro has surged quite a bit since the election, it’s not quite done yet.

As Macron took office last Sunday, the stock market insiders revealed some very telling signs through the Euro.

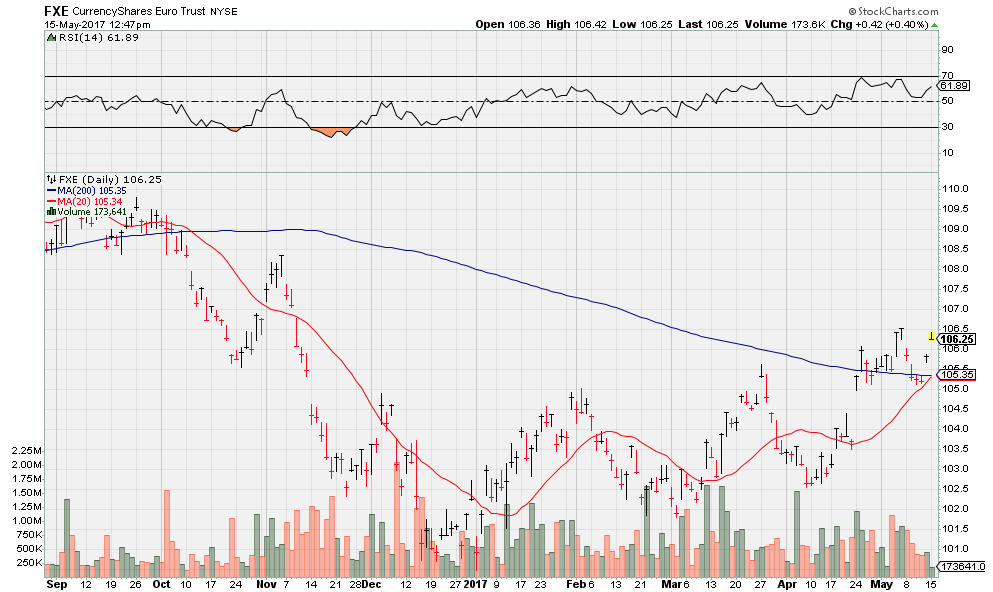

Take a look at the chart below for the CurrencyShares Euro Trust ETF (FXE)—the stock we use to trade the euro.

As you can see, on April 24th, the day after Macron won the first round of the French election, FXE jumped up almost $2 a share. It then went on to surge another dollar and change after Macron’s inauguration.

Now, the interesting thing about this chart has to do with its 200-day moving average (the curvy blue line running horizontally across the chart).

For a while, FXE was on my ‘do not buy’ list. That’s because since October 2016 it remained under that 200-day moving average.

Since the French election, you’ll see that the price has jumped up above that 200-day moving average and has remained above since.

Not only did it break that 200-day moving average, but it pulled back down toward it and leaped right off it in the past few days.

This is an extremely bullish sign, and I’d be surprised if this stock didn’t take off into the stratosphere considering everything it has going for it.

With the currently flat stock market conditions, I’ve turned to trading some currencies, and this one is so close to falling into that “buy” position.