I think we could agree that walking out into your backyard and diving into a pool full of cash would be the absolute dream.

I think we could agree that walking out into your backyard and diving into a pool full of cash would be the absolute dream.

All your financial woes would vanish, and you’d be able to buy everything you’ve ever wanted or needed.

The pool full of cash that I like to frequently dip into is more of a metaphorical one, but the cash is as real as it gets. So, get ready to drain your pool and let me fill it with more cash than you could ever desire.

The pool full of cash that I’m referring to is currently being replenished by energy stocks.

Of course, the source that refills that pool of cash changes from time to time, but why would you pull the hose away if the money is still pouring out?

In the first couple of trading days in 2017, energy stocks continued their upward momentum to reveal an average of 7% gains.

A 7% gain may not seem huge, but the fact that this gain has come from just two days indicates that these stocks are very strong at the moment.

Energy stocks, specifically, seem to be strongly influenced by the general market, and 2017 has started right where 2016 left off: strong.

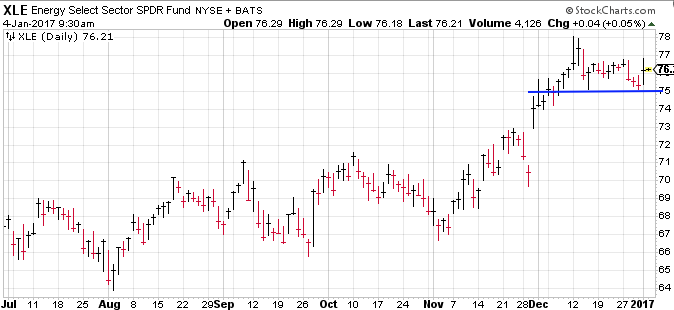

The general trend of energy stocks can be found by looking at the stock ticker XLE, which is an index of all the energy stocks that are available for trading.

If we take a look at the chart for XLE, you’ll see that I’ve drawn a blue line where the price keeps bouncing off. This line is supporting the price at around $75, and sending it upward each time it comes near.

If we analyze the energy sector a little more we’ll see that energy stocks are at their highest price since the summer of 2015, and it doesn’t look like they’ll be losing their steam any time soon.

Some individual stocks that I’m soon looking to fill my cash pool with are Marathon Petroleum (MPC), which gained 6.6%; Transocean (RIG), which flew 7.6%; and Seadrill (SDRL), which gained 6.7%.

Now, these 6% and 7% gains start to really add up if you enter the trade at the sweet spot and get out at the perfect time.

On SDRL alone I’ve already made a 10% gain, and now it looks like it’s going to top off my pool again in the near future.

This isn’t to say that energy stocks are the go-to of 2017; it’s just that they look to be approaching that prime position for maximum gains, but it’s all about timing.

If you really would like to take a dip in this pool full of cash that replenishes itself time and time again, check out our C.H.I.R.P. stock service, where we’ll be keeping you up to date on all the latest market action, while showing you where you can get your very own auto-replenishing cash pool.